High-Tech Push Boosts China’s Chipmakers

Chinese semiconductor stocks have soared recently, as investors bet these companies will benefit from Beijing’s quest for high-tech self-reliance.

The Chinese government is eager to become self-sufficient in key technologies amid trade tensions with the U.S. and as the Trump administration seeks to thwart access to semiconductors for China’s Huawei Technologies Co.

Investors are also hopeful that demand will rise as countries upgrade their wireless networks and the coronavirus pandemic encourages consumers to spend more time at home. Huawei, as a major global player in telecommunication equipment and handsets, would benefit from those international trends. This in turn could boost local semiconductor firms, if Huawei uses more products that are designed and made in China.

An index of Chinese semiconductor stocks that are traded in Shanghai and Shenzhen has gained more than a third this year, data from Wind shows. In contrast, the PHLX Semiconductor Sector Index, or SOX, in the U.S. is down about 4%.

Onshore stocks like Will Semiconductor Ltd., GigaDevice Semiconductor (Beijing) Inc., and NAURA Technology Group Co. and Unigroup Guoxin Microelectronics Co. have hit record highs this year.

Kevin Anderson, head of investments for Asia-Pacific at State Street Global Advisors, said self-reliance was “almost a foundational measure for China to really become a leading 21st-century high-value economy.”

In a show of commitment, China set up a $29 billion fund in October to nurture its domestic chip industry.

Mr. Anderson said a surge in people working or studying from home had helped speed up long-term growth in cloud computing and e-commerce, as well as fueling a short term surge in demand for laptop and desktop computers. He said State Street maintains active positions in Chinese semiconductor companies but doesn’t comment on individual stocks.

Shares of Hong Kong-listed Semiconductor Manufacturing International Corp. have risen more than 50% this year, giving China’s leading chip maker a market value of about $13 billion.

The firm is seeking another stock listing on Shanghai’s nascent high-technology board. It said this month that two state funds would invest $2.25 billion in its factory in Shanghai.Gary Zhang, a partner at Shenzhen Grand Gold Capital Co., said investors believe SMIC will keep taking market share from Taiwan Semiconductor Manufacturing Co., as Huawei gradually localizes production of chips that it designs in-house.

His firm invested in SMIC in March and increased its holdings in April. “The growth potential is huge but it’s a very long-term process with high uncertainty,” he said.

Mainland Chinese investors own nearly 23% of SMIC through a trading link with Hong Kong, while American investors include funds managed by Vanguard Group, BlackRock and Fidelity, according to FactSet.

Individual investors dominate mainland Chinese markets and often latch onto “concept stocks” seen as embodying a particular theme, such as 5G telecommunications or industrial hemp.

In one potential sign of overexuberance, SMIC’s stock price has risen to 52.7 times forecast earnings for the next 12 months, versus 17.2 times for TMSC, according to FactSet.

Pruksa Iamthongthong, senior investment director for Asian equities at Aberdeen Standard Investments, said China’s effort to localize production is here to stay.

But she said it wasn’t clear how quickly companies would be able to catch up with more advanced foreign rivals, nor if the drive would translate into sustainable corporate profits. At present, Chinese groups can’t make chips as small and fast as the cutting-edge products made by rivals like TSMC. The world’s largest contract chip maker, TSMC counts Apple Inc. and Huawei among its customers.

Ms. Iamthongthong said due to high valuations and the wide technological gap, her fund owns stocks in firms like TSMC and Silergy Corp., as well as Hong Kong-listed ASM Pacific Technology Ltd., rather than mainland companies.

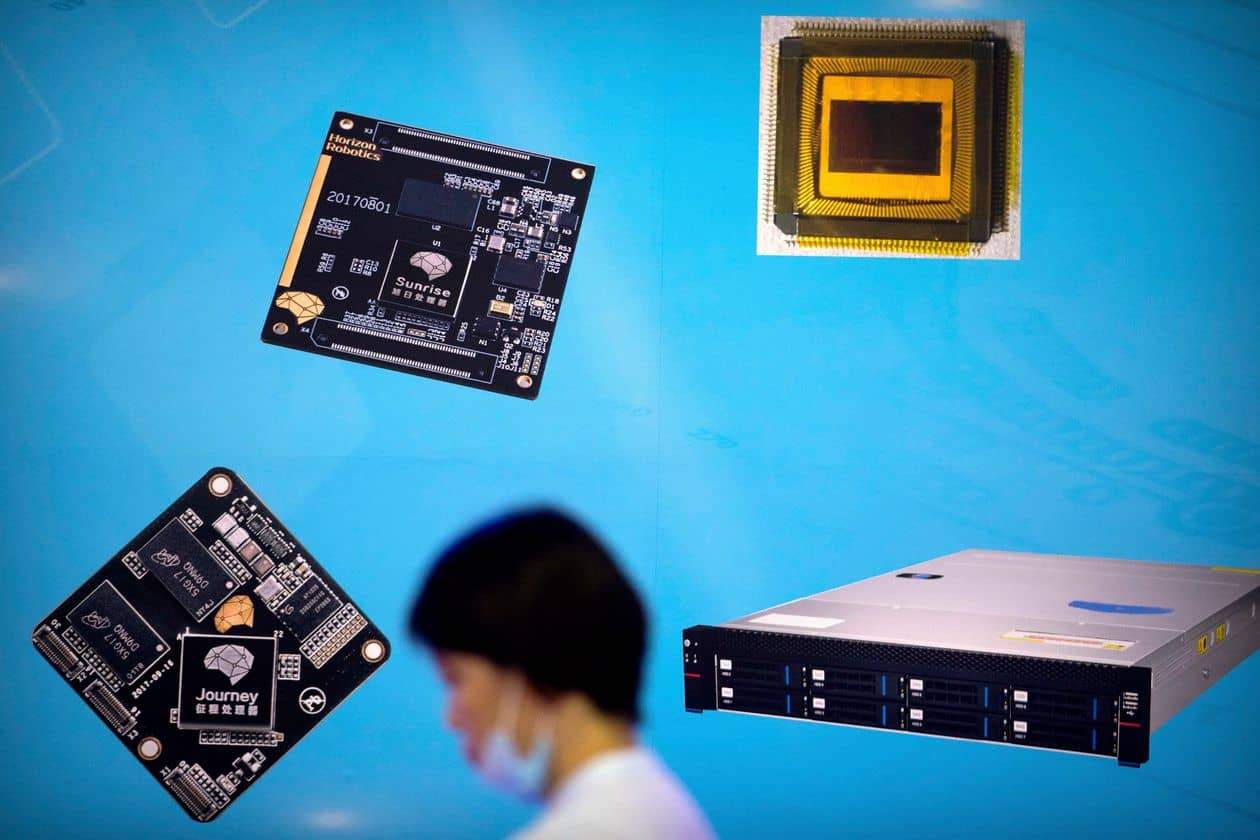

Photo: A visitor passes a display showing chips and circuit boards at a tech expo in Beijing in 2018. - MARK SCHIEFELBEIN/ASSOCIATED PRESS

Link: https://www.wsj.com/articles/high-tech-push-boosts-chinas-chipmakers-11589967003