China Chases Self-Reliance in Chips, but the U.S. Still Holds a Trump Card

Sales at HiSilicon, Huawei’s in-house chip design company, jumped 54% last quarter from a year earlier, making it the first Chinese company to enter the top ten in global semiconductor sales, according to market research firm IC Insights. More than 90% of HiSilicon’s sales go to Huawei, according to the report.

The Trump administration’s restrictions on U.S. companies selling to Huawei has forced the Chinese company to find alternatives to its American suppliers. While smartphone shipments in China collapsed 20% in the first quarter due to the coronavirus pandemic, Huawei’s market share has gone up to 43% from 36% a year earlier, according to IDC. As a result, HiSilicon has also overtaken Qualcomm in China as the top vendor for system-on-chip, an integrated circuit containing the central processor in smartphones. HiSilicon’s Kirin chipsets go into Huawei’s smartphones, including its flagship model P40 Pro. China’s buildout of 5G networks will also boost HiSilicon, whose chips will power Huawei’s base stations.

But Huawei still isn’t totally self-reliant. HiSilicon is a so-called fabless semiconductor company which doesn’t have its own manufacturing plant. It relies on foundry companies like Taiwan Semiconductor Manufacturing Co. to make its chips. The Trump administration is preparing rules that could restrict TSMC’s sales to HiSilicon. Huawei may be storing up chip inventories in anticipation of such tighter restrictions.

Huawei may shift some of its orders to Chinese foundry Semiconductor Manufacturing International Corp., but technology there still lags behind industry leaders like TSMC and Samsung. SMIC’s Hong Kong-listed shares nonetheless have gained 43% this year as investors expect more orders coming from other Chinese companies. Its stock got a boost this week as it unveiled a plan to raise potentially billions of dollars on Shanghai’s Science and Technology Innovation Board, which could give the company a much higher valuation.

But ultimately SMIC’s capabilities could be hampered if the Trump administration decides to dial up the pressure in its campaign against China. The Commerce Department said last week that it would expand the list of U.S.-made products and technology shipped to China that need to be reviewed by national security experts before shipping. SMIC depends on foreign semiconductor manufacturing equipment, including some from the U.S.

In the race for 5G supremacy and technological self-sufficiency, Huawei has steadily gained ground over the past two years despite American pressure. But the U.S. still holds a powerful trump card at the top of the value chain, should it choose to use it.

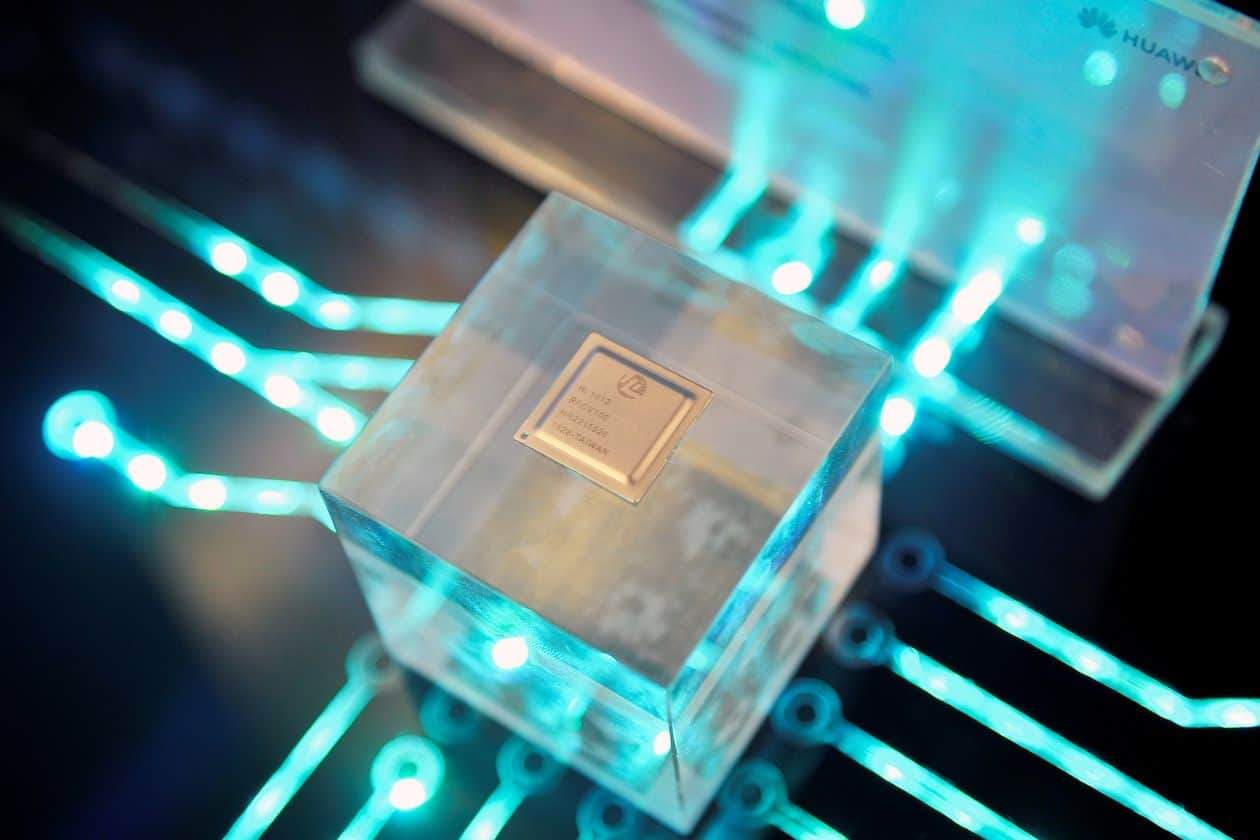

Photo: A chip from HiSilicon, Huawei’s in-house chip design company. - PHOTO: CHINA STRINGER NETWORK/REUTERS